Understanding the intricacies of investment analysis can be daunting, especially when dealing with various financial metrics that help assess the viability of an investment. One such critical metric is the Internal Rate of Return (IRR), which measures the profitability of potential investments. Investors often seek efficient ways to calculate IRR, and financial calculators provide a quick and reliable method to derive this key figure. In this article, we will explore how to calculate IRR using a financial calculator, along with the fundamental concepts surrounding this essential financial metric. Whether you're a seasoned investor or just beginning your journey, understanding how to navigate financial calculators can significantly enhance your investment decision-making process.

Calculating the IRR is not just a mathematical exercise; it is a vital skill that can influence investment strategies and portfolio management. The IRR reflects the expected annual rate of return on an investment, given a series of cash inflows and outflows over time. By utilizing a financial calculator to compute this value, investors can make informed decisions about where to allocate their resources, thereby maximizing their returns while minimizing risks. This article will guide you through the step-by-step process of calculating IRR using a financial calculator, ensuring you have the necessary tools to succeed.

Moreover, as we delve deeper, we will address common questions surrounding IRR calculations, the significance of this metric in financial planning, and how to interpret the results effectively. Understanding the IRR can empower you to evaluate investment opportunities more critically and optimize your financial outcomes. Let's embark on this journey to demystify the process of calculating IRR using a financial calculator.

What is IRR and Why is it Important?

IRR, or Internal Rate of Return, is a financial metric used to evaluate the profitability of potential investments. It represents the discount rate at which the net present value (NPV) of all cash flows (both inflows and outflows) from an investment equals zero. The significance of IRR lies in its ability to provide a single percentage figure that reflects the expected annual return on an investment, allowing investors to compare different opportunities on a like-for-like basis.

How Does IRR Differ from Other Financial Metrics?

When evaluating investment opportunities, IRR is often compared to other financial metrics such as Net Present Value (NPV) and Return on Investment (ROI). Here’s how they differ:

- Net Present Value (NPV): NPV calculates the difference between the present value of cash inflows and outflows, factoring in a specific discount rate. Unlike IRR, which provides a rate of return, NPV provides a dollar value indicating how much an investment will earn or lose.

- Return on Investment (ROI): ROI measures the efficiency of an investment by comparing the gain or loss relative to its cost. ROI is expressed as a percentage, whereas IRR is an annualized rate of return.

How to Calculate IRR Using Financial Calculator?

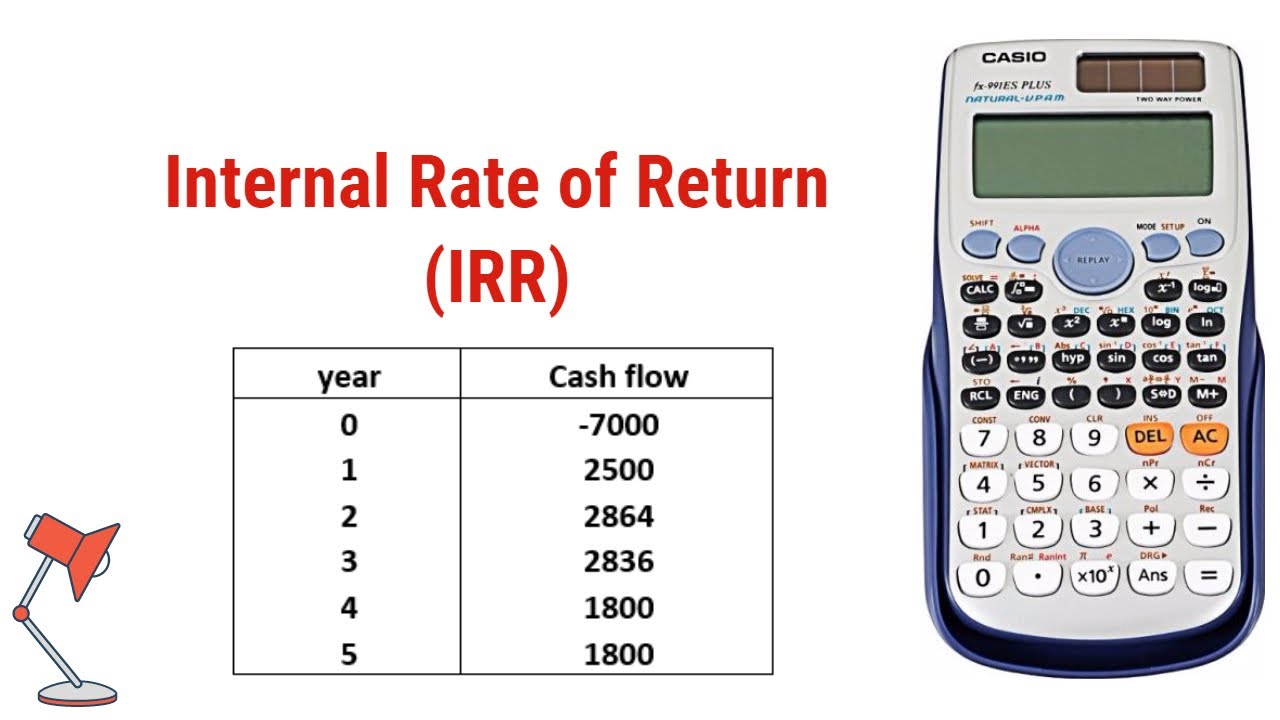

Calculating IRR using a financial calculator is a straightforward process. Here’s a step-by-step guide to help you through:

- Input Cash Flows: Enter the initial investment as a negative cash flow followed by the expected positive cash flows for subsequent periods. For example, if you invest $10,000 and expect to receive $3,000 each year for the next five years, you would input: -10,000 (Year 0), 3,000 (Year 1), 3,000 (Year 2), 3,000 (Year 3), 3,000 (Year 4), 3,000 (Year 5).

- Select IRR Function: Most financial calculators have a dedicated IRR function. Locate this function, usually labeled as 'IRR' or 'I/Y', depending on the calculator model.

- Compute IRR: After inputting the cash flows and selecting the IRR function, press the compute button to display the IRR value. This value represents the annualized rate of return for the investment.

What are the Common Mistakes When Calculating IRR?

While calculating IRR is relatively simple, there are common pitfalls that investors should avoid:

- Incorrect Cash Flow Order: Ensure that cash flows are entered in chronological order, as the timing of cash flows significantly impacts the IRR calculation.

- Ignoring Initial Investment: Failing to input the initial investment as a negative cash flow can lead to an inaccurate IRR result.

- Assuming Single IRR: Some investments may have multiple IRRs, especially if cash flows change signs more than once. This can complicate decision-making.

What Factors Affect IRR Calculations?

Several factors can influence the IRR of an investment, including:

- Cash Flow Timing: The timing of cash flows can greatly affect the IRR. Earlier cash flows contribute more to the IRR than later ones.

- Investment Duration: Longer investment durations can lead to higher IRRs if cash inflows are consistently positive.

- Market Conditions: Changes in market conditions can impact expected cash flows, thereby affecting the IRR.

How to Interpret IRR Results?

Interpreting the results of an IRR calculation is crucial for making informed investment decisions. Here are some key points to consider:

- Comparison to Required Rate of Return: If the calculated IRR exceeds your required rate of return, the investment may be considered favorable.

- Risk Assessment: A higher IRR is generally indicative of higher risk. It's essential to evaluate whether the potential returns justify the risks involved.

- Multiple IRRs: If you encounter multiple IRRs, further analysis may be required to determine the best course of action.

Conclusion: Why You Should Calculate IRR Using Financial Calculator?

Calculating IRR using a financial calculator is an invaluable skill for investors looking to optimize their investment strategies. By understanding how to accurately compute this metric, you can compare various investment opportunities and make informed decisions that align with your financial goals. As you become more adept at calculating IRR, you'll gain confidence in your investment choices and be better equipped to navigate the complex world of finance.

In summary, the ability to calculate IRR and interpret its results effectively can empower you as an investor, enabling you to assess potential returns and risks more accurately. So, whether you're analyzing a new project or evaluating an existing investment, make it a practice to calculate IRR using a financial calculator and enjoy the benefits of enhanced financial decision-making.

Understanding The F Value In ANOVA: A Comprehensive Guide

Understanding Ed Kemper: The Necrophiliac Serial Killer

Maximizing Performance And Security: Cloudflare Best Practices