Understanding the Internal Rate of Return (IRR) is crucial for making informed investment decisions. It holds immense significance for finance professionals, investors, and businesses alike, as it provides insights into the profitability of potential investments. However, calculating IRR can often seem like a daunting task, especially for those unfamiliar with financial calculators. In this article, we will unravel the complexities of calculating IRR, guiding you step-by-step on how to effectively use a financial calculator for this purpose.

When evaluating investment opportunities, IRR serves as a vital metric that helps to compare the profitability of various options. By understanding how to calculate IRR on a financial calculator, you can streamline your investment analysis and make more strategic choices. This process is not only beneficial for financial analysts but also for individual investors seeking to maximize their returns. Join us as we delve into the practical aspects of IRR calculation and enhance your financial acumen.

In the following sections, we will address common queries related to IRR calculation and provide a comprehensive guide on utilizing financial calculators. This user-friendly approach will empower you to confidently assess potential investments and their associated risks. Let’s get started on this financial journey and unlock the secrets of IRR calculation!

What is IRR and Why is it Important?

The Internal Rate of Return (IRR) is a financial metric used to evaluate the profitability of potential investments. It represents the discount rate at which the net present value (NPV) of all cash flows from an investment equals zero. In simpler terms, IRR is the rate of return at which an investor can expect to break even on their investment. Understanding IRR is crucial for several reasons:

- It helps investors identify the most profitable investment opportunities.

- IRR allows for a straightforward comparison between projects or investments.

- It indicates the efficiency of an investment in generating returns.

How Do You Gather the Necessary Data for IRR Calculation?

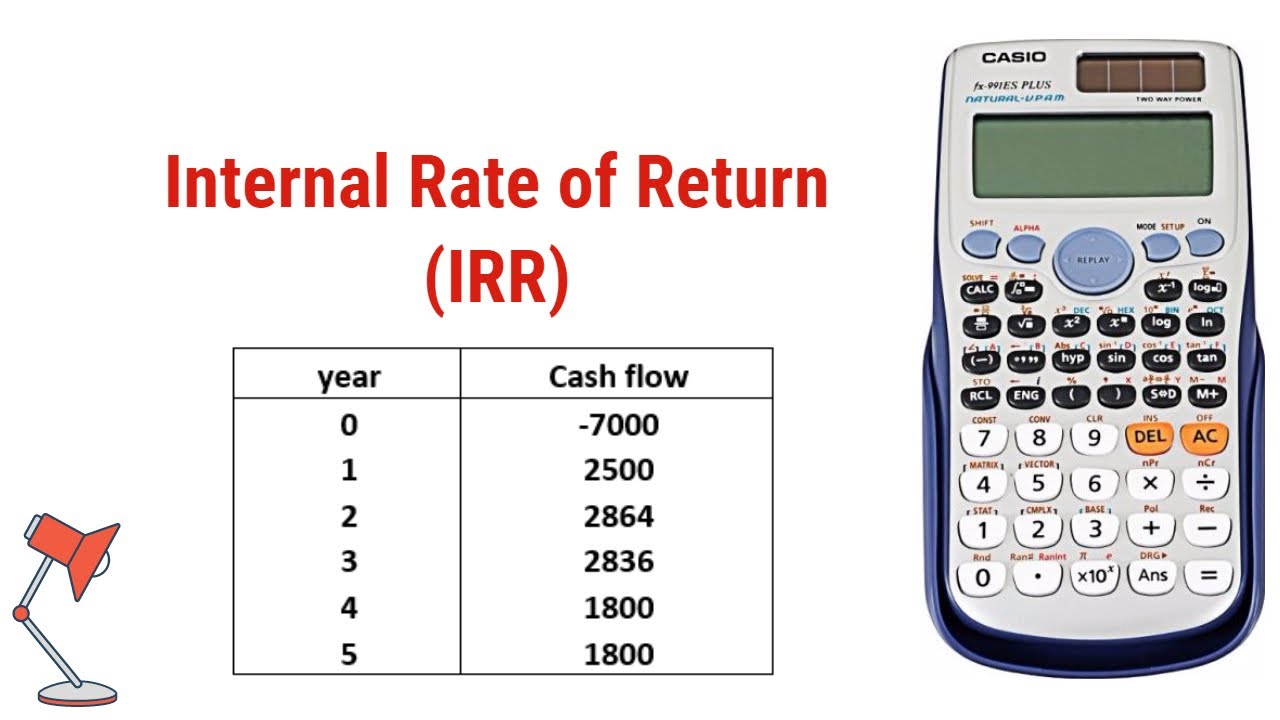

Before calculating IRR, you need to gather the appropriate cash flow data for the investment in question. This data typically includes:

- Initial Investment: The upfront cost associated with the investment.

- Cash Flows: The expected net cash inflows generated by the investment over time.

- Time Period: The duration over which the investment will generate cash flows.

Having this information at hand is crucial for accurately calculating IRR on a financial calculator.

What Steps Should You Follow to Calculate IRR on a Financial Calculator?

Now that you have gathered the necessary data, let’s walk through the steps to calculate IRR on a financial calculator:

- Input Cash Flows: Start by entering the cash flows into the calculator. Input the initial investment as a negative value (since it is an outflow) followed by the expected cash inflows for each period.

- Access the IRR Function: Locate the IRR function on your financial calculator. This may vary depending on the model, but it is usually found in the financial or cash flow section.

- Calculate IRR: Once you have entered all cash flows, select the IRR function and press the calculate button. The financial calculator will process the data and provide the IRR value.

What Financial Calculators Can You Use for IRR Calculation?

Various financial calculators can assist you in calculating IRR. Some popular options include:

- Texas Instruments BA II Plus: A widely used calculator among finance professionals.

- HP 10bII+: Another excellent choice for financial calculations, including IRR.

- Online Financial Calculators: There are many free online tools that can perform IRR calculations easily.

Choosing the right calculator is essential for accurate and efficient IRR calculations.

How Can You Interpret the IRR Value?

Once you have calculated the IRR, it is vital to understand what the value represents. A higher IRR indicates a more profitable investment, while a lower IRR suggests a less favorable return. Here’s how to interpret the IRR value:

- Compare to Required Rate of Return: If the IRR exceeds your required rate of return, the investment is considered viable.

- Compare to Other Investments: Use IRR to compare multiple investment opportunities and select the one with the highest return.

- Consider the Risk: Higher IRRs may also indicate higher risks; thus, consider the risk profile of the investment.

What Common Mistakes Should You Avoid When Calculating IRR?

When calculating IRR, it’s essential to avoid common pitfalls that could lead to inaccurate results:

- Incorrect Cash Flow Entries: Ensure that you enter cash flows accurately, especially the initial investment as a negative value.

- Neglecting Timing: Pay attention to the timing of cash flows, as they significantly impact the IRR calculation.

- Overlooking Multiple IRRs: Be aware that some cash flow patterns may result in multiple IRR values, complicating decision-making.

How Can You Practice Calculating IRR on a Financial Calculator?

To gain confidence in calculating IRR, practice using real-life examples. Here are some steps to help you practice:

- Find Sample Investment Scenarios: Look for case studies or examples of investments with known cash flows.

- Use Your Financial Calculator: Input the cash flow data into your calculator and calculate the IRR.

- Compare Results: Check your results against provided IRR values to gauge your accuracy.

Conclusion: Why Mastering IRR Calculation is Crucial?

In conclusion, mastering how to calculate IRR on a financial calculator is vital for making informed investment decisions. Understanding IRR empowers you to evaluate potential investments, compare different opportunities, and assess their profitability accurately. By following the steps outlined in this article and avoiding common mistakes, you can confidently navigate the world of finance and enhance your investment strategies.

Remember, practice makes perfect! Keep refining your skills in IRR calculation, and you will undoubtedly see a positive impact on your investment decisions.

Understanding Access Key AWS: Your Gateway To Amazon Web Services

Discovering Adazure: A Unique Journey Into Innovation

Understanding The Importance Of Abductor And Adductor Muscles