Understanding how to use a financial calculator to calculate IRR (Internal Rate of Return) can be a game-changer for investors and finance professionals alike. This powerful tool allows users to evaluate the profitability of potential investments by determining the rate at which the net present value (NPV) of future cash flows equals zero. As the investment landscape becomes increasingly complex, honing this skill is essential for making informed decisions.

In this article, we will explore the fundamentals of IRR, the mechanics of financial calculators, and provide a step-by-step guide on how to use financial calculator to calculate IRR effectively. Whether you're a seasoned investor or someone just starting out on your financial journey, mastering IRR calculation will empower you to assess investment opportunities with confidence.

Moreover, we will address common questions and concerns that arise when calculating IRR, ensuring you have a comprehensive understanding of this crucial financial metric. Let's dive into the world of financial calculations and unlock the potential of your investment strategies!

What is IRR and Why is it Important?

IRR, or Internal Rate of Return, is a crucial financial metric used to evaluate the profitability of an investment. It represents the discount rate at which the present value of future cash flows from the investment equals the initial investment cost. Understanding IRR is important because it helps investors compare different investment opportunities and make informed decisions based on potential returns.

How Does a Financial Calculator Work?

A financial calculator is a specialized tool designed to perform complex financial calculations with ease. It simplifies the process of computing IRR by allowing users to input cash flow data and obtain results quickly. These calculators come equipped with various functions, including NPV, IRR, and amortization calculations, making them invaluable for finance professionals and investors.

What Are the Key Features of a Financial Calculator?

- Cash Flow Input: Easily input multiple cash flows over different periods.

- IRR Calculation: Automatically calculates the Internal Rate of Return based on cash flows.

- NPV Calculation: Computes the Net Present Value for assessing investment viability.

- Time Value of Money Functions: Includes features for calculating present and future values.

How to Use Financial Calculator to Calculate IRR Step-by-Step?

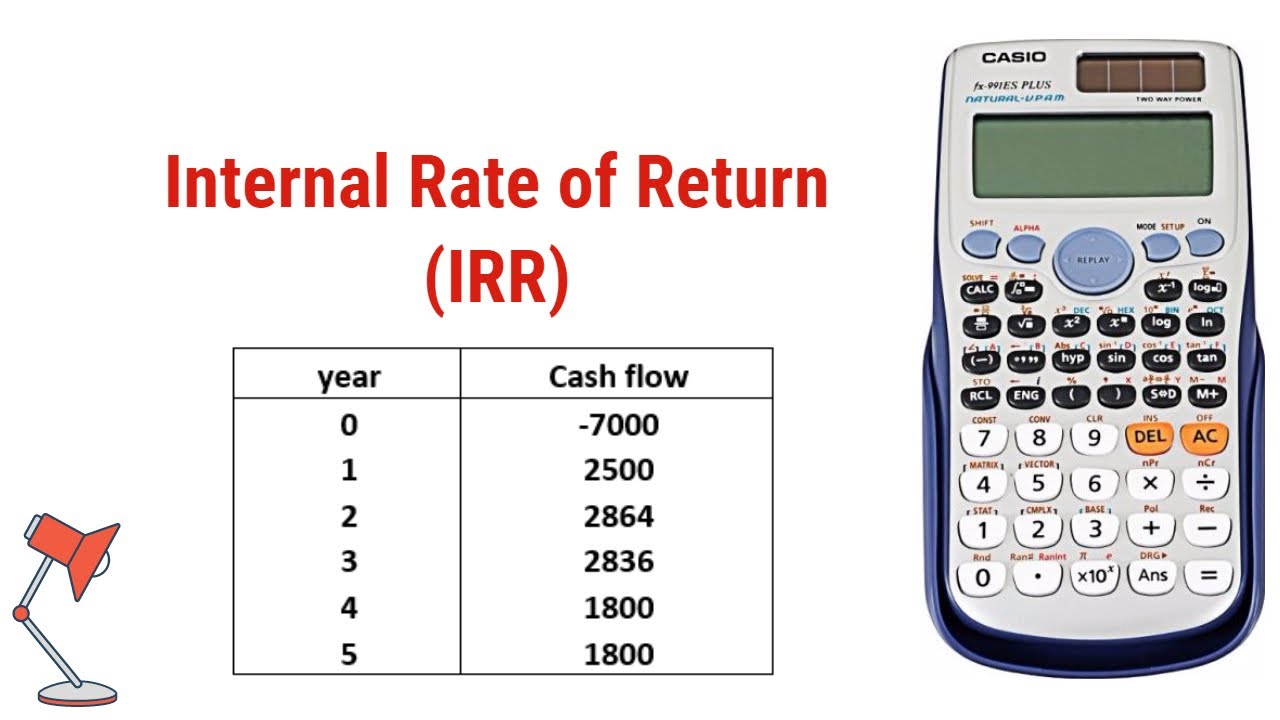

Calculating IRR using a financial calculator is straightforward when you follow these steps:

- Gather Your Cash Flow Data: List all expected cash flows, including the initial investment (which is usually a negative number) and subsequent inflows.

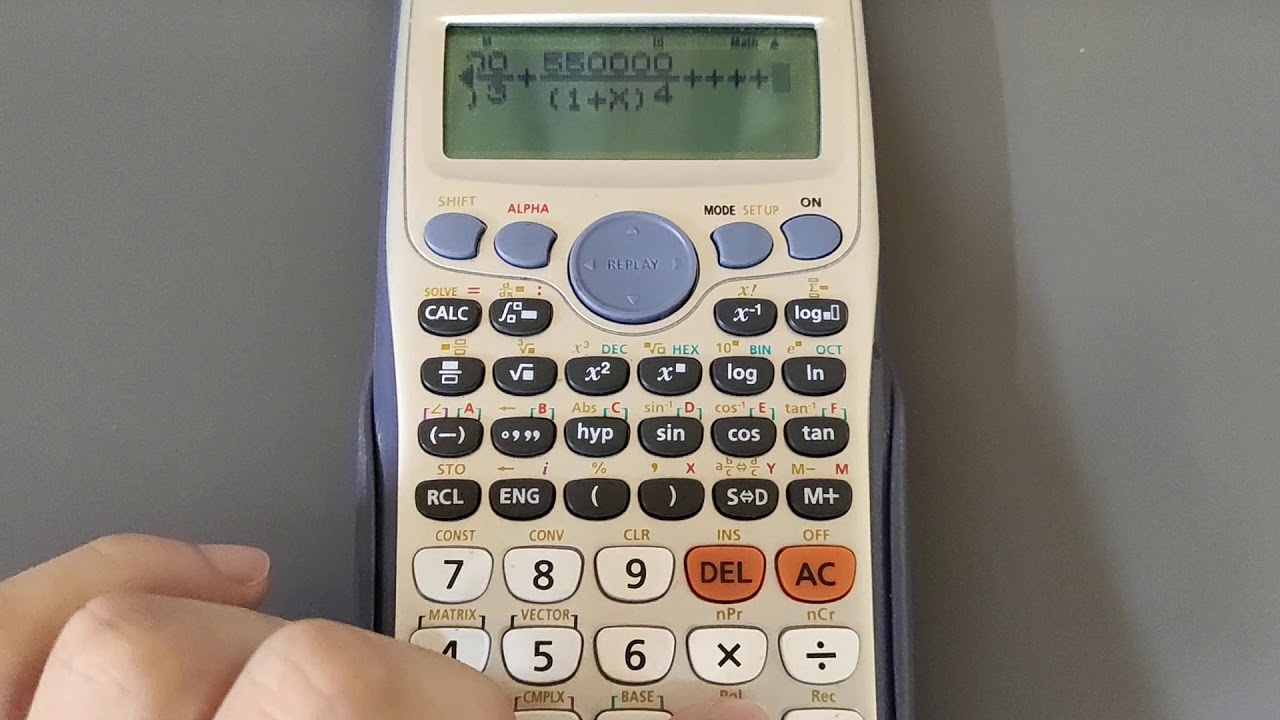

- Access the Cash Flow Feature: Turn on your financial calculator and select the cash flow function (often labeled as CF).

- Input Cash Flows: Enter the initial investment amount followed by the projected cash inflows for each period.

- Select the IRR Function: Once all cash flows are entered, find the IRR function on the calculator.

- Calculate IRR: Press the calculate button to determine the IRR. The calculator will display the rate at which NPV equals zero.

What Common Mistakes Should You Avoid?

While using financial calculators is generally straightforward, there are common pitfalls to be aware of:

- Incorrect Cash Flow Input: Ensure that cash flows are entered accurately, particularly the initial investment amount.

- Missing Periods: Make sure to include all cash flows for each relevant period; missing data can skew results.

- Ignoring the Context: Understand that IRR is not the only metric to consider; analyze alongside other financial indicators for a comprehensive view.

How to Interpret Your IRR Result?

Once you have calculated IRR using your financial calculator, interpreting the result is crucial. A higher IRR indicates a more profitable investment, but it is essential to compare it against your required rate of return or the cost of capital. If the IRR exceeds these benchmarks, it may be a worthwhile investment. Conversely, if it falls short, you might want to reconsider your investment strategy.

Can IRR Be Used in All Investment Scenarios?

IRR is a versatile metric, but it may not be applicable in every scenario. For instance, it can provide misleading results for non-conventional cash flows (where cash inflows and outflows alternate) or for investments with multiple IRRs. It is crucial to consider the context and use IRR in conjunction with other financial metrics for a well-rounded analysis.

Conclusion: Mastering the Use of Financial Calculator to Calculate IRR

By understanding how to use a financial calculator to calculate IRR, you equip yourself with a powerful tool for investment analysis. This knowledge not only helps in making informed decisions but also enhances your overall financial acumen. Remember to follow the steps outlined in this article, avoid common pitfalls, and always consider the broader financial context when evaluating investment opportunities. With practice, you can confidently navigate the intricacies of IRR and elevate your investment strategies to new heights.

```

Understanding The Location Of The T12 Vertebrae

Exploring Audrey Hepburn's Age During Breakfast At Tiffany's

The Perfect Balance: Understanding The Ideal Torso To Leg Ratio