In the realm of finance, understanding the returns on your investments is crucial for making informed decisions. One valuable tool to help you assess these returns is the IRR finance calculator. This powerful calculator simplifies the process of determining the internal rate of return (IRR) for various investment opportunities, allowing you to compare different projects and make sound financial choices. By calculating the IRR, you can gauge the profitability of a potential investment and determine if it meets your financial goals. Whether you're a seasoned investor or just starting, the IRR finance calculator is an essential resource that can enhance your investment strategy.

With the IRR finance calculator, you can input your projected cash flows and the initial investment amount to derive the rate of return expected from a particular project. This tool is particularly useful for evaluating long-term investments, as it considers the time value of money, which is a fundamental concept in finance. By understanding how to use this calculator effectively, you can make more strategic investment decisions and optimize your portfolio's performance.

In this article, we will explore the ins and outs of the IRR finance calculator, including its benefits, how to use it, and answers to common questions surrounding this financial tool. Armed with this knowledge, you'll be better equipped to navigate your investment journey and maximize your returns. Let’s dive into the world of the IRR finance calculator and discover how it can help you achieve your financial aspirations.

What is an IRR Finance Calculator?

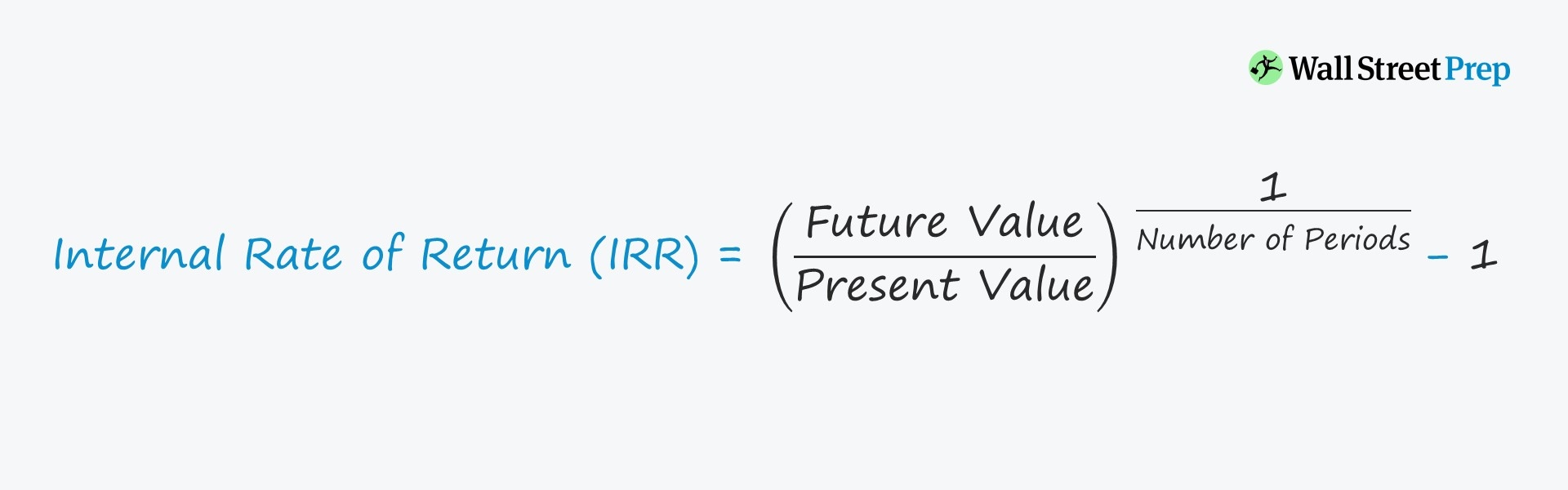

The IRR finance calculator is a specialized tool designed to calculate the internal rate of return for an investment or project. The IRR is a key metric that helps investors determine the potential profitability of their investments over time. By inputting expected cash flows and the initial investment, the calculator provides a clear percentage figure representing the investment's expected returns.

Why Should You Use an IRR Finance Calculator?

- Time Value of Money: The calculator considers the time value of money, enabling you to assess returns accurately over different time frames.

- Comparative Analysis: It allows you to compare multiple investment opportunities by calculating their respective IRRs.

- Informed Decision-Making: With precise calculations, you can make better-informed financial decisions regarding your investments.

- Risk Assessment: Understanding IRR helps you evaluate the risk associated with various investment projects.

How Do You Use an IRR Finance Calculator?

Using an IRR finance calculator is a straightforward process. Here’s a step-by-step guide:

- Gather Data: Collect all necessary information, including the initial investment amount and projected cash flows for each period.

- Input Values: Enter the initial investment and cash flow amounts into the calculator.

- Calculate IRR: Hit the calculate button to receive the internal rate of return for your investment.

- Analyze Results: Review the IRR value and compare it with your required rate of return to make an informed decision.

What Factors Influence the IRR Calculation?

Several factors can affect the IRR calculation, including:

- Cash Flow Timing: The timing of cash flows significantly impacts the IRR, as earlier cash flows are more valuable than later ones.

- Investment Duration: Longer investment horizons can lead to different IRR outcomes.

- Market Conditions: Changes in the economic landscape can influence projected cash flows and, consequently, the IRR.

How Does IRR Compare to Other Financial Metrics?

While IRR is a valuable metric, it’s essential to understand how it compares to other financial measures:

- Net Present Value (NPV): Unlike IRR, which provides a percentage return, NPV calculates the value of cash flows in today's terms.

- Return on Investment (ROI): ROI is a simpler metric that compares the profit of an investment to its cost, without considering the time value of money.

What Are the Limitations of Using an IRR Finance Calculator?

While the IRR finance calculator is a powerful tool, it comes with limitations:

- Multiple IRRs: In some cases, projects may have multiple IRRs, leading to confusion about which rate to use.

- Assumes Reinvestment: The IRR calculation assumes that cash flows are reinvested at the same rate, which may not always be feasible.

- Ignores Scale: IRR does not account for the size of the investment, potentially misleading investors when comparing projects of different scales.

Can You Rely Solely on the IRR Finance Calculator for Investment Decisions?

While the IRR finance calculator is a valuable resource, it should not be the only factor in your investment decision-making process. Consider combining the IRR metric with other financial assessments, such as NPV and ROI, to gain a more comprehensive understanding of potential investments. Additionally, conducting thorough market research and considering qualitative factors can further enhance your investment strategy.

Conclusion: How the IRR Finance Calculator Can Enhance Your Investment Strategy?

In conclusion, the IRR finance calculator is an indispensable tool for investors seeking to evaluate the potential returns on their investments. By understanding its functionality and limitations, you can leverage this calculator to make informed financial decisions that align with your investment goals. Remember to use the IRR in conjunction with other financial metrics and qualitative assessments to develop a well-rounded investment strategy. With the right tools and knowledge, you can navigate the complex world of finance and work towards achieving your financial aspirations.

Unraveling The Complex Relationship: Ed Kemper And His Mom

Mastering The Progress Bar In Bootstrap: A Comprehensive Guide

Unraveling The Dark Legacy Of Edmund Kemper: What Did He Do To His Mom?